Secure your legacy with life insurance.

The partner you can trust to help you navigate life insurance.

Shop Life InsuranceYour marketplace for America's top insurers

The partner you can trust to help you navigate life insurance.

Shop Life InsuranceYour marketplace for America's top insurers

Navigating the journey of life requires foresight, especially when considering the legacy you leave behind. Life Insurance isn’t just a policy – it’s a promise. Life insurance provides financial protection for your loved ones in the event of your passing. With life insurance, you ensure that your family’s future financial needs are not only met but handled with utmost care and integrity.

Life insurance provides a safety net for your loved ones in the case of your untimely passing. Depending on your policy, it can offer a lump sum payment, ongoing financial support, or even coverage for funeral expenses, ensuring that your loved ones can grieve without additional financial burdens.

Evaluate the financial needs of your dependents, consider any debts you might leave behind, and ponder on the lifestyle you’d like your family to maintain in your absence. Aim for a policy that offers ample coverage based on these considerations.

Begin by analyzing your responsibilities and the potential financial gaps. Then, consult a trusted insurance advisor. At Leverage, we make the process smooth, offering personalized advice and adaptable policies.

Every insurance company pitches protection, but not all are equipped to help you navigate the nuances of life insurance. At Leverage, we blend decades of experience with tech-forward solutions. Here are some things to consider when looking for your best option:

Reputation and Stability: Go beyond the commercials and find companies that have a long record of demonstrated financial strength.

Flexibility in Options: Look for companies that present a range of life insurance options so that you find the right coverage for you.

Customer Support: The true measure of a company’s commitment is its post-sale service. A dedicated team that’s available when you need them is invaluable.

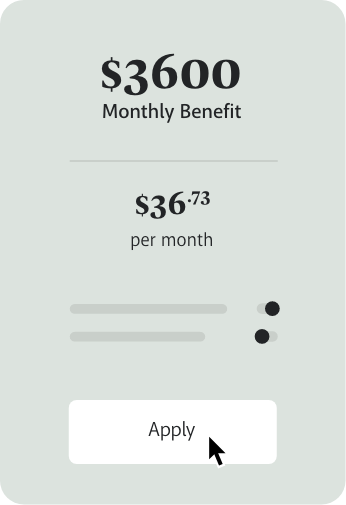

When considering Life Insurance, it’s important to understand the elements that dictate its cost. It’s more than just a price tag – it’s a reflection of a safeguarded legacy. Let’s dive into the components shaping your Life Insurance investment:

Generally, the younger you are when you buy life insurance, the more affordable the premium. As we age, insurers see increased risks, which can raise the cost.

An individual in tip-top shape will get friendlier rates, as they’re seen as a safer bet. If you have a medical history or certain pre-existing conditions, your price might be bit higher.

This relates to the sum that would be paid out upon your passing. A heftier payout means a bigger premium. Consider your beneficiaries’ needs and future expenses to gauge this.

Envisioning a long-term commitment or just need coverage for a period of time? The term length of your policy can vary from a few years to an entire lifetime. Naturally, longer spans might mean pricier policies.

Life is unpredictable. Maybe you want added benefits like accident coverage or benefits for terminal illness. Opting for these extras can influence your premium, but they add layers of protection tailored just for you.

At Leverage, we prioritize clarity and straightforward guidance. We’ll help you navigate your insurance options to ensure you get a policy that’s both cost-effective and suits your needs. With Leverage, you’re not just purchasing insurance – you’re building a safety net alongside experts who genuinely care.

When traditional coverage doesn’t fit

Life insurance is about safeguarding your family’s future, but everyone’s journey is unique. Sometimes, alternatives to conventional life insurance might be a better fit. At Leverage, we believe in securing that future, even if it means taking a different path.

With Leverage, it’s not just about providing options—it’s about painting the full picture, helping you understand the details and guiding you through your options to ensure your final choice meets your life goals and unique circumstances.

Where Insurance Expertise and Cutting-Edge Technology Meet.

At Leverage, we do more than just offer insurance. We focus on finding the best fit for you. We partner with top life insurance companies to bring you a wide range of options so we can find you the perfect coverage for your needs.

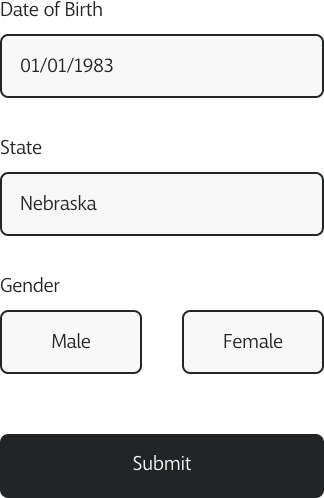

At Leverage, we value clarity and simplicity. Share your details with us, and our team will put together a clear presentation of your policy choices, complete with rates and features from different providers.

When you work with a Leverage insurance expert, they’ll lay out all your options in easy-to-understand terms. They’ll answer any questions and help you make decisions based on your objectives.

Our relationship doesn’t end once you have your policy. Whether you have questions, need adjustments, or just want to chat about your coverage, we’re here for you, ensuring you navigate your life insurance journey with confidence.

Our combination of bold strategies, wisdom accrued over years, and a transparent, client-first approach ensures you get not just an insurance policy, but a trusted partner.

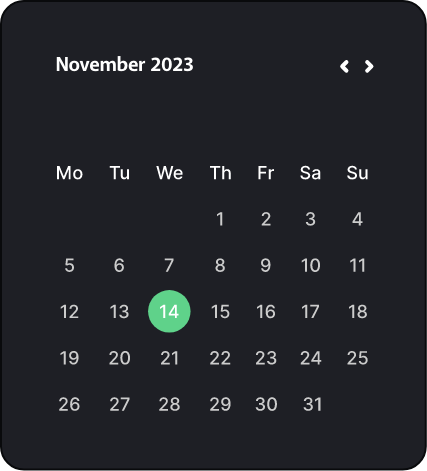

You'll join one of our experts for a brief video call, where they'll walk you through your options and rates. This is the perfect time to ask clarifying questions to make your decision easy.

Nope! We are compensated by the insurance company after you purchase your policy. We do not charge anything for our expert advice.

By working with all major carriers and quoting multiple options at each, we are able to present you with all your options and eliminate the hours of online research you would have to do yourself.

Your Simple Path to a Secure Future.

Tell us your needs, and we'll present the best options tailored for you.

Discuss, clarify, and gain insights from the best in the business.

Once satisfied, apply with confidence. We're with you at every step.