What is Long-Term Care Insurance?

When we think about healthcare, we often focus on medical treatments for acute illnesses or injuries. However, there is another crucial aspect of healthcare that often goes overlooked: long-term care. Long-term care encompasses a wide range of services designed to assist individuals with chronic illnesses, disabilities, or cognitive impairments. These services support individuals in completing daily activities they may no longer be able to perform independently.

Long-term care can be provided in various settings, including nursing homes, assisted living facilities, adult day care centers, and even in the comfort of one’s own home. The primary goal of long-term care is to ensure that individuals receive the necessary assistance and support to maintain their quality of life and independence.

Services Covered by Long-Term Care Insurance

Long-term care insurance serves as a financial safety net, providing coverage for the costs associated with long-term care services. These services can include assistance with activities of daily living (ADLs), such as bathing, dressing, eating, toileting, and transferring. Long-term care insurance may also cover instrumental activities of daily living (IADLs), including housekeeping, meal preparation, medication management, transportation, and money management.

By having long-term care insurance, individuals can have the peace of mind knowing that they have access to the care they need without depleting their savings or burdening their loved ones. It allows for greater flexibility in choosing the type and location of care that best suits their preferences and needs.

How Does Long-Term Care Insurance Work?

When an individual with long-term care insurance requires care, they must meet the policy’s eligibility criteria to activate the benefits. This typically involves demonstrating a need for assistance with specific ADLs or meeting certain cognitive impairment criteria.

Once the eligibility criteria are met, the policyholder can begin receiving benefits. The insurance company will typically reimburse the policyholder for covered expenses up to a predetermined daily, weekly, or monthly limit. The policy may have a waiting period, also known as an elimination period, during which the policyholder is responsible for paying for their care before the insurance coverage begins.

It’s important to note that long-term care insurance policies have limitations and exclusions. These can include restrictions on pre-existing conditions, limitations on the duration of coverage, and specific requirements for care settings or providers. It’s crucial to carefully review the terms and conditions of the policy before purchasing to ensure it aligns with your anticipated needs.

The Growing Need for Long-Term Care

The need for long-term care is increasing, as the population ages. According to the U.S. Department of Health and Human Services, approximately 70% of individuals over the age of 65 will require some form of long-term care during their lifetime. This statistic highlights the importance of planning for long-term care needs in advance.

While Medicare provides coverage for certain medical services, it does not typically cover the costs associated with long-term care services. Private health insurance plans, including employer-sponsored plans, also generally exclude coverage for long-term care. Therefore, without proper planning and insurance coverage, individuals may be responsible for significant out-of-pocket expenses when they require long-term care services.

Understanding Long-Term Care Insurance

Long-term care insurance is a type of insurance policy specifically designed to cover the costs associated with long-term care services. It provides financial protection by reimbursing policyholders for expenses related to care received in various settings, including nursing homes, assisted living facilities, and in-home care.

The policyholder pays a premium to the insurance company in exchange for the coverage provided by the policy. The specific terms and conditions of the policy, including the types of services covered, benefit amounts, and benefit periods, can vary depending on the insurance company and the policy selected.

How Does Long-Term Care Insurance Work?

When an individual with long-term care insurance requires care, they must meet the policy’s eligibility criteria to activate the benefits. This typically involves demonstrating a need for assistance with specific ADLs or meeting certain cognitive impairment criteria.

Once the eligibility criteria are met, the policyholder can begin receiving benefits. The insurance company will typically reimburse the policyholder for covered expenses up to a predetermined daily, weekly, or monthly limit. The policy may have a waiting period, also known as an elimination period, during which the policyholder is responsible for paying for their care before the insurance coverage begins.

It’s important to note that long-term care insurance policies have limitations and exclusions. These can include restrictions on pre-existing conditions, limitations on the duration of coverage, and specific requirements for care settings or providers. It’s crucial to carefully review the terms and conditions of the policy before purchasing to ensure it aligns with your anticipated needs.

Who Should Consider Long-Term Care Insurance?

Long-term care insurance is not right for everyone. It is most beneficial for individuals who have a significant risk of needing long-term care services in the future and have the financial means to afford the premiums. Factors to consider when determining if long-term care insurance is appropriate for you include:

-

Age at Time of Purchase:

The younger you are when you purchase long-term care insurance, the lower the premiums are likely to be. However, it’s essential to balance the cost of premiums over an extended period with the risk of needing care in the future.

-

Health Status:

Long-term care insurance generally requires medical underwriting, which means your health status can impact your ability to qualify for coverage. Individuals in good health may have more options and lower premiums.

-

Financial Situation:

Long-term care insurance can be costly, and premiums can increase over time. It’s crucial to consider your financial situation and whether you can afford the premiums both now and in the future.

-

Family History:

If you have a family history of chronic illnesses or conditions that may require long-term care, it may be wise to consider long-term care insurance as a means of financial protection.

-

Personal Preferences:

Long-term care insurance provides flexibility in choosing the type and location of care. If you have specific preferences for the type of care you would like to receive, long-term care insurance may help you fund those choices.

Determining whether long-term care insurance is suitable for your situation requires careful consideration of these factors. It can be beneficial to consult with a financial advisor or long-term care insurance specialist who can provide personalized guidance based on your unique circumstances.

Benefits of Long-Term Care Insurance

Long-term care insurance offers several significant benefits to policyholders and their families:

Financial Protection: Long-term care services can be expensive, and the costs can quickly deplete savings and assets. Long-term care insurance provides a financial safety net, ensuring that you have access to quality care without compromising your financial well-being.

Choice and Flexibility: With long-term care insurance, you have the freedom to choose the type and location of care that best suits your preferences and needs. Whether you prefer in-home care, assisted living, or a nursing home, your insurance coverage can help you afford the care you desire.

Preservation of Assets: Without long-term care insurance, individuals may need to spend their savings and assets to cover the costs of care. Long-term care insurance helps protect your assets, allowing you to pass them on to your loved ones or use them for other purposes.

Reduced Burden on Family: Long-term care needs can place a significant burden on family members and caregivers. Having long-term care insurance can alleviate some of this burden by providing financial resources for professional care services, reducing the need for family members to take on caregiving responsibilities.

Peace of Mind: Knowing that you have a plan in place for long-term care can bring peace of mind to both you and your loved ones. Long-term care insurance provides reassurance that you will have the necessary resources to receive the care you need, allowing you to focus on enjoying life.

Understanding the benefits of long-term care insurance can help you make an informed decision and find the right choice for your situation. It’s essential to carefully evaluate your needs, preferences, and financial capabilities to determine if long-term care insurance aligns with your overall financial plan.

Evaluating Long-Term Care Insurance Providers

Selecting the right long-term care insurance provider is crucial to ensure that you receive the coverage and support you need when the time comes. When evaluating different insurance companies, consider the following factors:

Reputation and Financial Stability: Choose a long-term care insurance provider with a solid reputation and a history of financial stability. Look for companies that have been in business for a significant period and have a strong presence in the insurance industry.

Research the company’s financial strength ratings from independent rating agencies such as A.M. Best, Standard & Poor’s, and Moody’s. These ratings provide insight into the insurer’s ability to meet its financial obligations to policyholders.

Customer Satisfaction and Reviews: Customer satisfaction is an important indicator of an insurance company’s performance and reliability. Look for customer reviews and ratings to gain insight into the experiences of policyholders with the company.

Consider factors such as customer service, claims processing, and overall satisfaction. Online review platforms, consumer advocacy organizations, and industry-specific publications can be valuable resources for gathering customer feedback.

Claim Process and Support: Understanding the claim process and the support provided by an insurance company is essential. Investigate how the company handles claims, including the ease of filing a claim, the timeliness of claim processing, and the availability of customer support throughout the process.

Look for insurance companies that have a dedicated claims department and provide clear instructions and resources for policyholders. Prompt and efficient claims processing can make a significant difference when you need to access your long-term care insurance benefits.

Expert Ratings and Rankings: Industry experts and organizations often evaluate and rank long-term care insurance providers based on various criteria. Consider reviewing ratings and rankings from reputable sources such as J.D. Power, Consumer Reports, and the American Association for Long-Term Care Insurance.

These ratings can provide insights into the overall quality of the insurance company, its products, and its customer service. However, it’s important to consider multiple sources and weigh the ratings against your specific needs and preferences.

Comparing Quotes and Policies: Obtaining quotes from multiple insurance companies is an essential step in evaluating long-term care insurance providers. Working with an LTC broker like Leverage can simplify this process. Request quotes that match your desired coverage amount, benefit period, elimination period, and other important policy features.

When comparing quotes, consider not only the premium cost but also the overall value the policy provides. Evaluate the coverage, policy features, and any additional riders or options included in each quote.

Working with an experienced insurance advisor can be invaluable during the evaluation process. They can help you analyze quotes, explain the nuances of different policies, and guide you in selecting the right long-term care insurance provider.

By thoroughly evaluating long-term care insurance providers, you can make an informed decision and choose a company that aligns with your needs and provides the support and coverage you require.

Peace of Mind: Knowing that you have a plan in place for long-term care can bring peace of mind to both you and your loved ones. Long-term care insurance provides reassurance that you will have the necessary resources to receive the care you need, allowing you to focus on enjoying life.

Understanding the benefits of long-term care insurance can help you make an informed decision and find the right choice for your situation. It’s essential to carefully evaluate your needs, preferences, and financial capabilities to determine if long-term care insurance aligns with your overall financial plan.

Additional Considerations for Long-Term Care Planning

In addition to understanding long-term care insurance costs and coverage, it’s important to consider other aspects of long-term care planning. Several factors may impact your long-term care needs and financial situation. Here are some key considerations:

Medicaid Eligibility and Spend-Down Rules: Medicaid is a joint federal and state program that provides financial assistance for long-term care services to individuals with limited income and assets. Eligibility requirements vary by state but generally include income and asset limits.

Before purchasing long-term care insurance, it’s crucial to understand Medicaid eligibility and the spend-down rules. Long-term care (LTC) insurance is a significant investment that demands careful consideration. It’s not merely about the expense—it’s about securing quality care and peace of mind for the future.

Services Covered by Long-Term Care Insurance: LTC insurance covers a broad spectrum of both medical and non-medical services. Medical services, also known as Activities of Daily Living (ADLs), encompass:

-Bathing

-Dressing

-Toileting

-Mobility

-Incontinence care

-Eating and drinking assistance

-Housekeeping

-Medication management

-Financial management

-Grocery shopping

-Pet care

The High Costs of Long-Term Care Without Insurance: Without LTC insurance, the out-of-pocket costs for long-term care can be exorbitant. The annual cost of care varies widely, depending on the type, duration, and provider of care, as well as the patient’s location. For instance, the national average cost for a single year in a nursing home can exceed $100,000. In contrast, in-home care services can cost around $50,000 per year.

Factors Influencing the cost of Long-Term Care Insurance

When considering long-term care insurance, it’s essential to understand the various factors that can influence its cost. Several key elements contribute to the overall investment required for LTC insurance coverage. Let’s explore these factors in detail:

-

Age at Time of Purchase:

The age at which an individual purchases LTC insurance plays a significant role in determining the premium. Typically, the younger the policyholder, the lower the premium. As individuals age, insurance companies associate higher risks with providing coverage, resulting in increased costs.

-

Health Status:

An individual’s health status also impacts the cost of LTC insurance. Generally, healthier individuals may receive lower premiums, as they are perceived as lower risk. On the other hand, those with pre-existing conditions or a history of certain illnesses may face higher premiums due to the increased likelihood of requiring long-term care.

-

Benefit Amount:

The benefit amount refers to the daily or monthly benefit a policyholder would receive when using their LTC insurance coverage. A higher benefit amount corresponds to a higher premium. It’s important to consider the costs of long-term care in your desired location to estimate the appropriate benefit amount for your needs.

-

Benefit Period:

The benefit period determines how long an individual anticipates needing LTC insurance benefits. This period can range from a couple of years to a lifetime. Longer durations of coverage typically result in higher premiums due to the increased potential for benefit utilization.

-

Inflation Protection:

Over time, the cost of long-term care is likely to increase due to inflation. To ensure that the benefit amount keeps pace with rising care costs, some policies offer inflation protection. Opting for this feature can result in higher premiums, but it is crucial for policies expected to be used many years in the future.

-

Elimination Period:

Similar to a deductible period, the elimination period is the timeframe during which the policyholder must wait before their LTC insurance begins to pay out. Selecting a longer elimination period can lower the premium, but it also means that the policyholder will be responsible for covering more out-of-pocket costs during the waiting period.

-

Shared Benefit Rider:

For couples, some LTC insurance policies offer a shared pool of benefits. With a shared benefit rider, if one partner exhausts their benefits, they can tap into the other partner’s pool of benefits. This flexibility can influence the cost of LTC insurance coverage.

-

Policy Add-ons or Riders:

Additional features, known as policy add-ons or riders, can be included in LTC insurance coverage. These additions may offer protection against specific conditions or provide additional benefits in certain scenarios. Each policy add-on or rider will have an associated cost, which can impact the overall LTC insurance premium.

Average Premiums for Long-Term Care Insurance

The cost of premiums can vary significantly based on the factors mentioned above. On average, a single 55-year-old male may expect to pay around $1,700 per year, while a female of the same age may pay approximately $2,675 annually for a policy with a $165,000 benefit amount.

The Tax Benefits of Long-Term Care Insurance

One silver lining is that LTC insurance premiums are tax-deductible up to a certain limit. However, the specifics of tax benefits can vary based on individual circumstances and tax laws.

Partnering with Leverage for Long-Term Care Insurance

At Leverage, we want to help you to choose a plan that aligns perfectly with your anticipated needs. We believe that investing in LTC with Leverage is about forging a partnership for your future—one that prioritizes transparency, personalized solutions, and lasting relationships.

Long-term care (LTC) services provide essential assistance to individuals with chronic illnesses or disabilities. These services can be received in nursing homes, assisted living facilities, or even in the comfort of one’s own home. However, most employer-sponsored private insurance plans and Medicare do not cover the costs of long-term care. Without a stand-alone LTC insurance policy, individuals may face significant out-of-pocket expenses, ranging from $20,000 to $100,000 annually, depending on the level of care required.

Key Takeaways

Understanding the cost of long-term care insurance is essential for individuals seeking to protect themselves from the financial burdens associated with long-term care services. Factors such as age, health status, benefit amount, benefit period, inflation protection, elimination period, shared benefit rider, and policy add-ons or riders can all influence the overall cost of LTC insurance coverage. By working with Leverage, you can gain a clearer understanding of these factors and make an informed decision about your long-term care insurance investment. Don’t let the cost of long-term care catch you off guard—plan ahead and secure your financial well-being.

How Leverage Works:

Securing Your Future, Simplified.

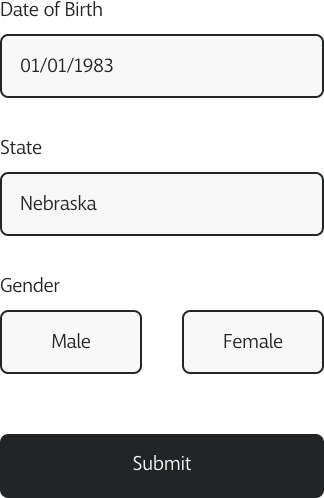

Request a Quote:

Tell us your needs, and we'll present the best options tailored for you.

Meet Virtually with Our Experts:

Discuss, clarify, and gain insights from the best in the business.

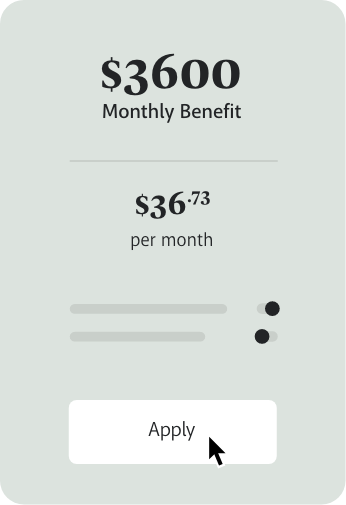

Apply for Coverage:

Once satisfied, apply with confidence. We're with you at every step.

Annuities and Your Retirement Plan

Including annuities in your retirement plan adds a valuable source of guaranteed income later in life. With deliberate planning and the advice of an expert, adding an annuity to your retirement plan can help ensure a comfortable and worry-free retirement.

Read the article

How Fixed Annuities Can Ease Long-Term Care Costs in Retirement

A deferred annuity is a contract you have with an annuity company. You pay them money, either all at once (a lump sum) or over several payments, and in return, the annuity company promises to give you back this money later in payments, plus interest. The date that you start receiving this money is called the annuity date. This is when your annuity begins to pay you, and there are different types of deferred annuities to consider.

Read the article

Fixed Annuities: Debunking Common Misconceptions

A deferred annuity is a contract you have with an annuity company. You pay them money, either all at once (a lump sum) or over several payments, and in return, the annuity company promises to give you back this money later in payments, plus interest. The date that you start receiving this money is called the annuity date. This is when your annuity begins to pay you, and there are different types of deferred annuities to consider.

Read the article