Long Term Care Insurance: A Guide to Protecting Your Future

As we age, it’s important to plan for the future and ensure that we have the necessary financial protection in place. One crucial aspect of this planning is long-term insurance. Long-term care insurance is designed to bridge the gap and cover costs that health insurance won’t. In this comprehensive guide, we will explore everything you need to know about long-term care insurance, from its purpose and how it works to the cost and tax advantages. By the end of this article, you’ll have a clear understanding of long-term insurance and be better equipped to make informed decisions about your future.

Understanding Long-Term Care Insurance

What is Long-Term Care Insurance?

Long-term care insurance is a type of insurance policy that helps cover the costs of long-term care services. Long-term care refers to the many services that are not insured by regular health insurance. These services include assistance with daily activities such as bathing, dressing, and eating. A long-term care insurance policy provides financial support for these services when you have a chronic medical condition, disability, or disorder like Alzheimer’s disease. It can be used to cover care provided in various settings, including your home, nursing homes, assisted living facilities, and adult day care centers.

The Importance of Long-Term Care Planning

Considering long-term care costs is an essential part of any long-range financial plan, especially as you reach your 50s and beyond. Waiting until you actually need care to buy coverage is not an option, as you may no longer qualify for long-term care insurance if you have a debilitating condition. Additionally, most long-term care insurance carriers won’t approve applicants older than 75. Therefore, it’s crucial to plan ahead and purchase long-term care insurance in your mid-50s to mid-60s. The right time to buy long-term care insurance depends on your unique situation and preferences.

Reasons to Buy Long-Term Care Insurance

Protecting Your Savings

One of the primary reasons to buy long-term care insurance is to protect your savings. The costs associated with long-term can quickly deplete your retirement nest egg. For example, the median cost of a semi-private nursing home room is $94,900 per year. By having long-term care insurance in place, you can avoid the financial burden of paying for these costs out of pocket. Instead, the insurance policy will help cover the expenses, allowing you to preserve your savings for other needs.

Providing More Choices for Care

Another significant benefit of long-term care insurance is that it gives you more choices for care. The amount of money you spend directly impacts the quality of care you receive. With long-term care insurance, you have the flexibility to choose the type of care that suits your specific needs and preferences. On the other hand, relying solely on Medicaid might limit your options, as Medicaid often only covers certain facilities or services. By having long-term care insurance, you can have access to a wider range of care providers and facilities.

How Long-Term Care Insurance Works

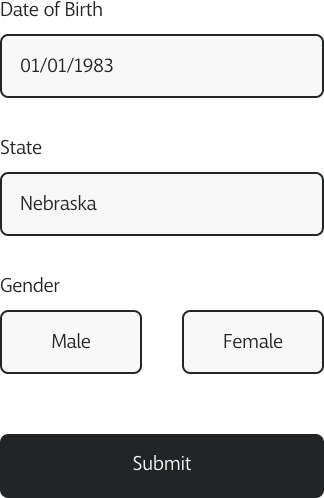

Applying for Long-Term Care Insurance

To purchase a long-term care insurance policy, you will need to fill out an application and answer health-related questions. The insurance company may also request to see your medical records or conduct an interview. During the application process, you will have the opportunity to choose the amount of coverage you want. The policy will typically have a cap on the amount paid out per day and during your lifetime.

Eligibility for Benefits

You will begin paying premiums after you are approved for coverage and the policy is issued. To be eligible for benefits, most long-term care policies require that you are unable to perform at least two out of six activities of daily living (ADLs) on your own. These ADLs include bathing, dressing, eating, toileting, transferring, and continence. Alternatively, if you suffer from dementia or other cognitive impairments, you may also be eligible for benefits.

Making a Claim

When you need care and want to make a claim, the insurance company will review your medical documents and may send a nurse to evaluate your condition. Before approving a claim, the insurer will need to approve your plan of care. In most cases, you will have to pay for long-term care services out of pocket for a certain period of time, known as the elimination period, before the insurer starts reimbursing you for any care. Once the elimination period is over, the policy will start paying out up to a daily limit for care until you reach the lifetime maximum.

The Cost of Long-Term Care Insurance

Factors Affecting the Cost

The price of long-term care insurance can fluctuate based on multiple factors. These factors include your age, health, gender, marital status, insurance company, and the amount of coverage you desire. Generally, the older you are and the more health problems you have, the higher your premiums will be. Women generally pay more than men, as they tend to live longer and have a higher chance of making long-term care insurance claims. Premiums are often lower for married individuals compared to single individuals.

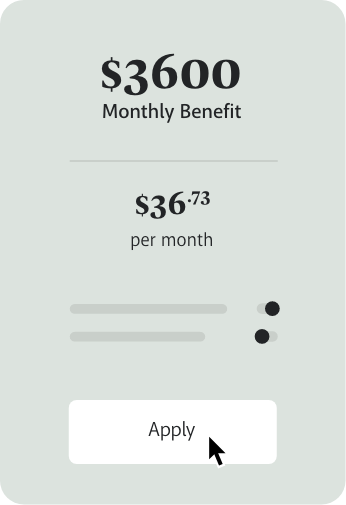

Average Costs

To give you an idea of the average costs, a single 55-year-old man in good health can expect to pay an average of $2,100 per year for a long-term care policy with an initial pool of benefits of $165,000.For an identical plan, a 55-year-old solo female might anticipate an average expense of $3,600 annually. For a 55-year-old couple each purchasing that level of coverage, the total average premiums amount to $5,025 annually. However, it’s important to note that prices can vary among insurance companies, so it’s recommended to work with a broker like Leverage to compare quotes from different carriers.

How Leverage Works:

Securing Your Future, Simplified.

Request a Quote:

Tell us your needs, and we'll present the best options tailored for you.

Meet Virtually with Our Experts:

Discuss, clarify, and gain insights from the best in the business.

Apply for Coverage:

Once satisfied, apply with confidence. We're with you at every step.

Tax Advantages of Long-Term Care Insurance

Deductibility of Premiums

Long-term care insurance can offer tax advantages, especially as you get older. Both federal and some state tax codes allow you to deduct part or all of your long-term care insurance premiums as medical expenses if you itemize deductions. The amount of premiums you can deduct increases with your age. It’s important to note that only premiums for tax-qualified long-term care insurance policies count as medical expenses. These policies must meet certain federal standards and be labeled as tax-qualified.

How to Buy Long-Term Care Insurance

Buying from an Insurance Company or Agent

You can purchase long-term care insurance directly from an insurance company or through an agent. Some employers also offer the opportunity to buy coverage from their brokers at group rates. When buying coverage, you will need to answer health questions, and in some cases, provide medical records. It’s recommended to get quotes from multiple companies to compare prices and coverage options. Even if your employer offers coverage, it’s still beneficial to explore other options, as you might find better rates elsewhere. The best way to see your options from multiple companies and get expert advice is to work with an agent broker like Leverage.

State Partnership Plans

Many states have “partnership” programs with long-term care insurance companies.These initiatives are designed to motivate people to prepare for their future care requirements. The insurance companies participating in these programs offer policies that meet certain quality standards. By purchasing a partnership policy, you can protect more of your assets if you exhaust your long-term care benefits and need to rely on Medicaid. This can be particularly beneficial, as Medicaid typically requires individuals to spend down their assets to a certain level to qualify for benefits.

Is Long-Term Care Insurance Right for You?

Considerations and Personalized Solutions

Deciding whether long-term care insurance is the right choice for you involves considering various factors and personal preferences. It’s essential to assess your financial situation, health status, family history, and support network. Additionally, you should consider your retirement savings, income, and future healthcare needs. Consulting with an insurance brokerage like Leverage can help you evaluate your options and determine whether long-term care insurance aligns with your overall financial goals and objectives.

Key takeaways

Planning for long-term care is a crucial part of securing your financial future. Long-term care insurance provides a valuable financial safety net, covering the costs of care when health insurance falls short. By understanding the purpose, benefits, and considerations of long-term care insurance, you can make informed decisions and protect yourself and your loved ones from the potentially significant financial burden of long-term care expenses. Remember to thoroughly research and compare different policies and consult with a trusted insurance professional to find the best long-term care insurance solution for your unique needs. Start planning today and gain peace of mind for tomorrow.

Annuities and Your Retirement Plan

Including annuities in your retirement plan adds a valuable source of guaranteed income later in life. With deliberate planning and the advice of an expert, adding an annuity to your retirement plan can help ensure a comfortable and worry-free retirement.

Read the article

How Fixed Annuities Can Ease Long-Term Care Costs in Retirement

A deferred annuity is a contract you have with an annuity company. You pay them money, either all at once (a lump sum) or over several payments, and in return, the annuity company promises to give you back this money later in payments, plus interest. The date that you start receiving this money is called the annuity date. This is when your annuity begins to pay you, and there are different types of deferred annuities to consider.

Read the article

Fixed Annuities: Debunking Common Misconceptions

A deferred annuity is a contract you have with an annuity company. You pay them money, either all at once (a lump sum) or over several payments, and in return, the annuity company promises to give you back this money later in payments, plus interest. The date that you start receiving this money is called the annuity date. This is when your annuity begins to pay you, and there are different types of deferred annuities to consider.

Read the article